Zero Trust Architecture: The Future of BFSI Cybersecurity

The world is moving towards a more digitized financial era with cybersecurity emerging as a top priority concern for banks, financial institutions, and insurance companies. The Banking, Financial Services, and Insurance (BFSI) industry is confronted with some special challenges related to safeguarding sensitive customer information, upholding operational integrity, and ensuring regulatory compliance. This blog explores evolving cybersecurity threats in BFSI and how Techpartner helps organizations tackle them while ensuring regulatory compliance.

Acceleration of Digital Transformation

The BFSI industry has seen a rapid digital revolution in recent times. Conventional banking and financial services have gone online as mobile banking, online payments, and digital investment platforms become the order of the day. Though this change has enhanced accessibility and ease for consumers, it has also widened the attack surface for cyber attackers.

Financial institutions today handle an unprecedented number of digital transactions every day, each of which is a potential point of entry for threat actors. The pace of digital transformation projects, particularly in the wake of the global pandemic, has further increased cybersecurity risks as organizations moved to implement new technologies without always putting in place strong security controls.

Sophisticated Threat Landscape

The threat landscape in the BFSI industry continues to grow in terms of sophistication and magnitude. According to Accenture’s 2022 report, financial institutions face 300% more cyberattacks compared to other industries. Such attacks involve advanced persistent threats (APTs) and ransomware, complex social engineering campaigns and supply chain breach.

Threat actors compromising BFSI institutions are usually well funded and expertly skilled and use techniques capable of evading conventional security measures. State attackers, crime gangs, and hacktivist groups all pose novel challenges to the industry’s cyber defense.

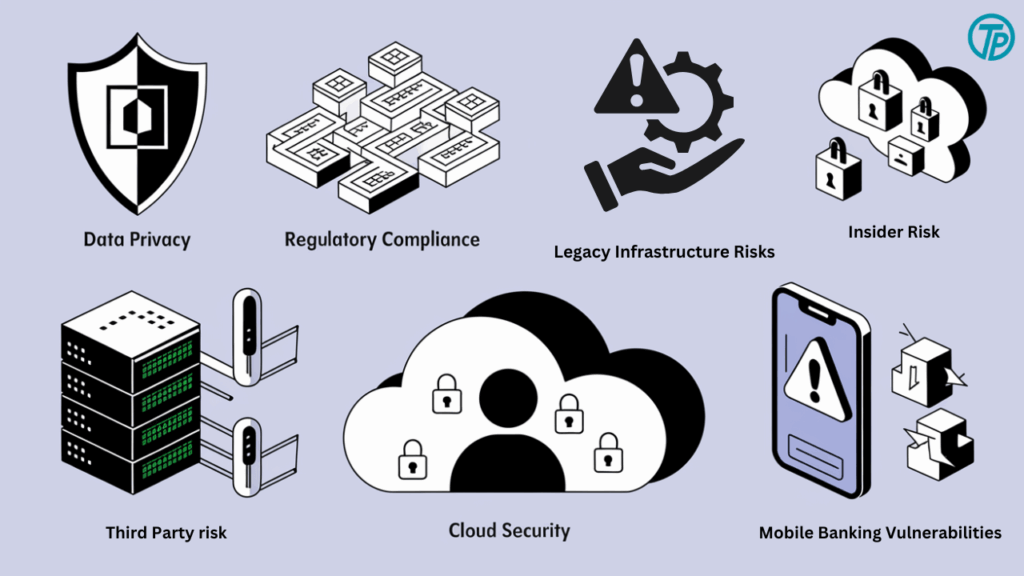

Most Important Cybersecurity Challenges in BFSI

1. Data Privacy and Protection

Financial institutions deal with enormous amounts of customers’ sensitive information such as personally identifiable information (PII), financial records, and transaction history. All this information makes them the most attractive target for data breaches and stealing.

A significant concern is the financial impact of data breaches. According to IBM’s Cost of a Data Breach Report 2024, the average cost of a data breach for financial firms is estimated at $5.85 million. This highlights the urgency for BFSI companies to strengthen data protection frameworks.

To mitigate risks, organizations must implement strong encryption, multi-factor authentication (MFA), and continuous monitoring. Compliance with regulations like RBI’s IT Framework for NBFCs, GDPR, and India’s Digital Personal Data Protection Act (DPDPA) ensures a proactive approach to safeguarding financial data.

2. Regulatory Compliance Complexity

The BFSI sector operates under stringent regulatory frameworks designed to protect consumers and maintain financial stability. Regulations such as the Reserve Bank of India’s (RBI) guidelines on cybersecurity, the Payment Card Industry Data Security Standard (PCI DSS), and various international frameworks like GDPR for global operations create a complex compliance landscape.

Financial institutions have to navigate these intersecting regulatory requirements while keeping up with constant updates and revisions. Proving ongoing compliance demands advanced monitoring, documentation, and reporting capabilities that are difficult for many organizations to sustain in-house.

3. Third-Party and Supply Chain Risks

Modern financial institutions utilize an ecosystem of fintech partners that provide third-party services. Outside of the organization’s direct management, each of these connections poses possible threats to security.

High-profile supply chain attacks in recent times have proven that attackers are capable of taking advantage of trusted vendor relationships to have access to multiple financial institutions at once. Overseeing such third-party threats needs thorough vendor assessment processes, real-time monitoring, and contractual security requirements.

4. Legacy Infrastructure Risks

Most well-established financial organizations are running on legacy infrastructure that was not originally developed with current cybersecurity threats in consideration. These systems tend to have minimal security controls, are hard to patch, and can no longer be supported by vendors.

Integrating these legacy systems with modern cloud-based services and applications creates additional security challenges. The complexity of these hybrid environments can lead to security gaps and misconfigurations that attackers can exploit.

5. Insider Threats

Not all cybersecurity threats come from external actors. Employees, contractors, and other insiders with legitimate access to systems and data can—intentionally or unintentionally—compromise security.

Privileged users with administrative access to key systems are a specific risk. Insider threats need to be managed by using a mix of technical controls, security awareness training, and sound access management policies designed to meet the unique requirements of financial institutions.

6. Cloud Security Issues

As BFSI firms shift more workloads to the cloud, they must address new security issues associated with cloud infrastructure, shared responsibility models, and requirements for data sovereignty. Security of cloud environments demands specialized knowledge and tools different from conventional on-premises security strategies.

Misconfigured cloud services and poor access controls in the cloud have contributed to many data exposures within the financial industry. Cloud-specific security measures need to be created to secure these rapidly growing environments by organizations.

7. Mobile Banking Vulnerabilities

The swift uptake of mobile banking apps has introduced fresh attack surfaces for cybercriminals. Mobile apps can have bugs in their code, authentication mechanisms, or data storage habits that can be taken advantage of by attackers to attain unauthorized access to customers’ accounts.

Maintaining the security of mobile banking platforms with uninterrupted user experience is a continuous challenge for financial institutions. Security testing on a regular basis, secure coding, and runtime application self-protection are all critical elements of a complete mobile security strategy.

How Techpartner Ensures Cybersecurity and Compliance in BFSI

Techpartner is proficient in BFSI specific cybersecurity issues and has designed tested solutions to enable organizations to protect their environments while keeping regulatory compliance intact. With more than 120 successfully implemented projects and 75+ satisfied customers worldwide, Techpartner offers tried-and-tested expertise to solve the most critical cybersecurity issues in the banking industry.

Comprehensive Security Assessment and Strategy

The process at Techpartner starts with an exhaustive evaluation of the organization’s current security environment, such as infrastructure, applications, data paths, and implemented security controls. Through this analysis, the following gaps are determined – vulnerabilities, compliance issues, and improvement opportunities.

From this analysis, Techpartner creates a custom security strategy according to the firm’s risk profile, regulatory requirements, and business goals. The strategic blueprint defines a clear course of action to advance security maturity while maximizing the utilization of available resources.

Regulatory Compliance Management

Understanding and complying with complex regulations is the cornerstone of Techpartner’s cyber practice. Our compliance professionals keep abreast of current regulations governing the BFSI industry, including:

- RBI Cybersecurity Framework

- Payment Card Industry Data Security Standard (PCI DSS)

- Information Technology Act and Rules

- General Data Protection Regulation (GDPR) for institutions with international operations

- SWIFT Customer Security Program (CSP)

Techpartner has compliance management systems in place that are automated for evidence gathering, control testing, and reporting to prove ongoing compliance with these regulations. It limits the administrative effort required by internal teams while offering end-to-end visibility into compliance status.

Advanced Threat Protection

Against advanced threats aiming at the BFSI industry, Techpartner rolls out advanced threat protection technologies beyond conventional security measures:

- Next-generation firewalls that include application-level inspection capabilities

- Endpoint detection and response (EDR) products that detect and isolate threats prior to their ability to spread

- Security information and event management (SIEM) systems that collect and correlate events throughout the environment to detect possible security incidents

- User and entity behavior analytics (UEBA) for identifying anomalous patterns that suggest compromise

- All these technologies come together as a unified security fabric that offers all-around protection to the digital assets of the organization.

Secure Cloud Transformation

When BFSI companies adopt cloud technology, Techpartner makes sure security is integrated in cloud migrations from the outset. Our cloud security strategy consists of:

- Cloud security posture management for detecting and remediation of misconfigurations

- Data protection controls that protect sensitive data across its lifecycle in cloud environments

- Identity and access management solutions designed for hybrid and multi-cloud deployments

- Continuous compliance monitoring for cloud workloads

Techpartner’s experience with both legacy infrastructure and cloud technologies allows a secure connection between these environments, safeguarding data and applications wherever they are located.

Zero Trust Architecture Implementation

To address the changing threat landscape, Techpartner assists BFSI companies in adopting Zero Trust security architectures that do not trust any user or system, irrespective of location or network.

This involves:

- Micro segmentation to restrict lateral movement across networks

- Robust authentication and authorization controls for all devices and users

- Continuous verification and validation of access requests

- Least privilege access principles enforced consistently throughout the environment

Zero Trust architectures are especially useful in the financial industry, where safeguarding high-value assets demands several layers of protection.

Security Operations Center (SOC) Services

Techpartner provides managed Security Operations Center services tailored for the BFSI industry. These services offer 24/7 monitoring, detection, and response functions to recognize and limit security incidents before they can affect vital systems or information.

Our SOC analysts undergo training on financial industry threats and compliance needs so that security monitoring is aligned with regulatory needs and risk factors in industry segments. The SOC also generates periodic reports and metrics that can be utilized to prove security diligence to regulators and stakeholders.

Third-Party Risk Management

To mitigate the substantial risks associated with third-party relationships, Techpartner has extensive vendor risk management programs that involve:

- Security questionnaires designed for various vendor risk profiles

- Technical verification of vendor security assertions using penetration testing and security analysis

- Regular monitoring of vendor security postures and weaknesses

- Contract terms that impose security requirements and incident response obligations

These initiatives guarantee that third-party relationships support instead of detracting from the overall security posture of the organization.

Security Awareness and Training

We understand that individuals are usually the first point of contact against cyber-attacks, Techpartner creates personalized security awareness and training programs for BFSI staff. These programs address:

- Identifying and reporting phishing attacks

- Secure management of customer information

- Password and authentication best practices

- Compliance requirements specific to various roles

Periodic simulated phishing tests and tabletop incident response exercises keep employees ready to respond to security incidents the right way.

Real-World Success:

Reserve Bank of India’s Secure Domain Initiative

In response to increasing cyber threats, the Reserve Bank of India (RBI) introduced a dedicated “.bank.in” domain for Indian banks. This initiative aims to enhance online security, reduce phishing attacks, and bolster confidence in digital banking systems. Registration for this domain commenced in April 2025, with plans to extend similar measures to the broader financial sector. The Economic Times.

These initiatives demonstrate the proactive steps Indian banks are taking to strengthen cybersecurity, protect customer data, and maintain trust in the digital banking ecosystem.

Conclusion: Building Cyber Resilience in BFSI

As digital transformation accelerates, cyber threats in BFSI are becoming more sophisticated. Financial institutions must adopt a proactive security strategy to safeguard assets, ensure regulatory compliance, and maintain customer trust. Zero Trust Architecture, robust compliance management, and advanced threat protection are essential to mitigating risks.

Techpartner provides tailored cybersecurity solutions, helping BFSI firms secure their infrastructure, protect sensitive data, and navigate regulatory complexities. By integrating modern security practices and continuous monitoring, organizations can strengthen their cyber resilience and stay ahead of evolving threats.

Follow our LinkedIn Page and check out our other Blogs to stay updated on the latest tech trends and AWS Cloud.

Set up a complimentary security assessment for your IT infrastructure